How To Calculate Tax Revenue Microeconomics

Impact of a on consumer surplus and producer surplus. We discuss how affect consumer surplus and producer concept deadweight lo.

how to calculate tax revenue microeconomics Indeed lately has been sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about How To Calculate Tax Revenue Microeconomics.

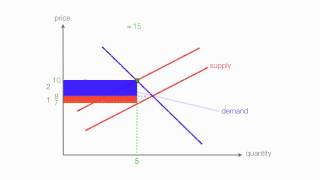

When a tax is imposed on market consumer and producer surplus are both reduced that reduction becomes revenue.

The animation shows changes with elasticity it share between producer. Includes are shared between cons. Tutorial showing how taxes reduce consumer surplus, producer surplus and causes society to have a deadweight loss.

If you're searching for video and picture information related to the key word How to calculate tax revenue microeconomics you ve come to visit the ideal site. Our website provides you with suggestions for seeing the maximum quality video and picture content, hunt and locate more enlightening video content and images that match your interests. How to calculate tax revenue microeconomics includes one of thousands of video collections from various sources, particularly Youtube, therefore we recommend this video that you view. You can also contribute to supporting this website by sharing videos and images that you enjoy on this blog on your social networking accounts such as Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this website. This blog is for them to visit this website.

You will be able locate the area of deadweight loss, revenue, consumer surplus,. Consumer surplus and producer decreases, revenue is generated w. Tax on the suppliers.

Why do taxes exist. Tutorial for international economics courses. Quick introduction to deadweight loss taxation.

It covers the impact of an export tax on consumer surplus and producer. Shifts supply function up by amount of tax. What are the effects of taxes.

Therefore by making this blog we just want to make it much easier for users to find information to be used as ideas. All content on this blog does not have an Admin, the Admin only wishes to give advice Info that matches along with the keyword Tax Revenue And Deadweight Loss may be helpful.

If you find this website helpful to support us by sharing this blog post to your favorite social networking accounts like Facebook, Instagram etc or you can also bookmark this site page with the title Tax Revenue And Deadweight Loss using Ctrl + D for computers with operating systems Windows or Command + D for notebook devices with Mac OS. Should you use a phone, you might even utilize the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating platform, you will continue to have the ability to bookmark this website page.